Penang Monthly charts the sources of federal government revenue.

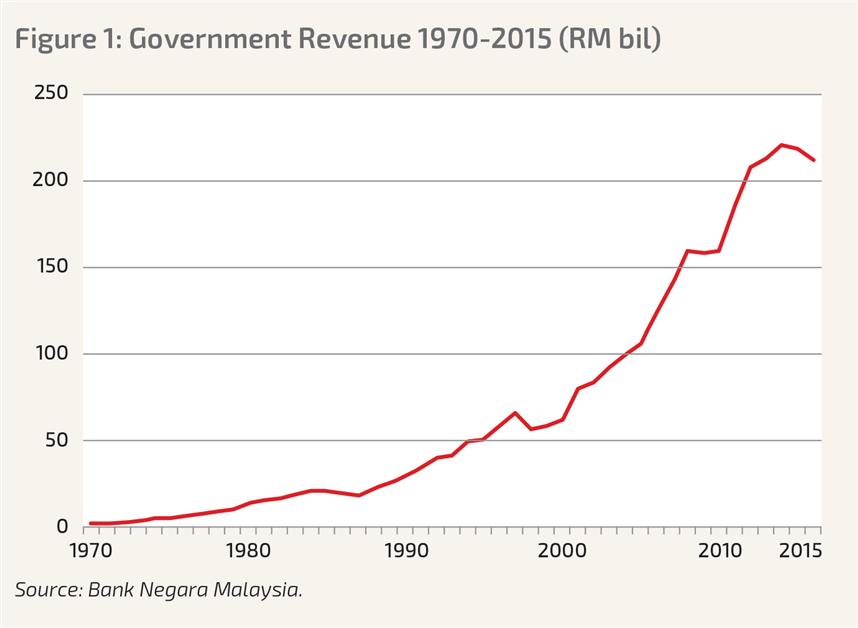

Over the last 45 years, government revenue has registered impressive annual growth rates: in 1970 it hit RM2.4bil; by 2015, it had exceeded RM219bil.

In Malaysia, the sources of government revenue are classified into three broad categories: tax revenue, non-tax revenue and non-revenue receipts.

Tax revenues are made of direct and indirect tax. Direct tax is levied and paid by the person on whom it is levied. Collection of direct tax falls under the jurisdiction of the Inland Revenue Board (IRB). Indirect tax is tax collected by a third party from the person who bears the tax payment burden. The responsibility of collecting indirect tax belongs to the Royal Customs and Excise Department.

Of the three, tax revenues are by far the largest and most important source of income. Between 1970 and 2015, tax revenue contributed an average of three-quarters of total revenue while non-tax revenue made up a quarter. Contributions from non-revenue receipts were negligible – in 2015, it was a mere 1% of total revenue.